In a time when the federal government is shut down and economic turmoil is all around, it is hard to stomach the idea of another economic meltdown. If Congress is not able to approve an increase on the debt limit by tomorrow, then the United States is in for another round of economic catastrophe.

Tomorrow, the U.S. government will work under a deadline with pressure that few really understand. This is the deadline for Congress to raise the debt limit so the federal government can keep paying its bills.

The debate to raise the debt limit, or debt ceiling, has been going on for months. However, many people do not even know what it is all about. Even many students at Weber State University struggle to give an accurate description of the debt ceiling.

“Government finances isn’t exactly my strong point,” said Joseph Faiola, a WSU student. “I believe it has something to do with the national debt and not letting it pass a certain point.”

Gary Johnson, associate professor of political science, said the debt limit is “the maximum amount that federal government has been approved to borrow to pay for its promises. We need the money to pay for the things that we have promised. Raising the debt limit will allow us to pay for these things.”

The federal government has a responsibility to cover costs of programs such as social security and veterans benefits. When the federal government runs out of money for these types of bills, it needs to find a way to cover the difference.

“It would be like having your credit card which has a $2,500 limit on it, and the company says they are going to raise your limit,” Johnson said. “Congress is saying that the limit they are willing to pay is about $16.7 trillion.”

The issue the government runs into is the time it hit this limit. As of tomorrow, the government will have met its spending limit, and now it is looking for an increase in its spending abilities.

The only problem is that raising the limit is not nearly as simple as calling a credit card company.

“Raising the debt ceiling is a vote by Congress to borrow the money needed to keep the government going,” Johnson said.

In order for Congress to approve more borrowing to meet the government’s needs, an agreement will need to be made in Congress. Both the House of Representatives and the Senate must approve the borrowing by tomorrow’s deadline.

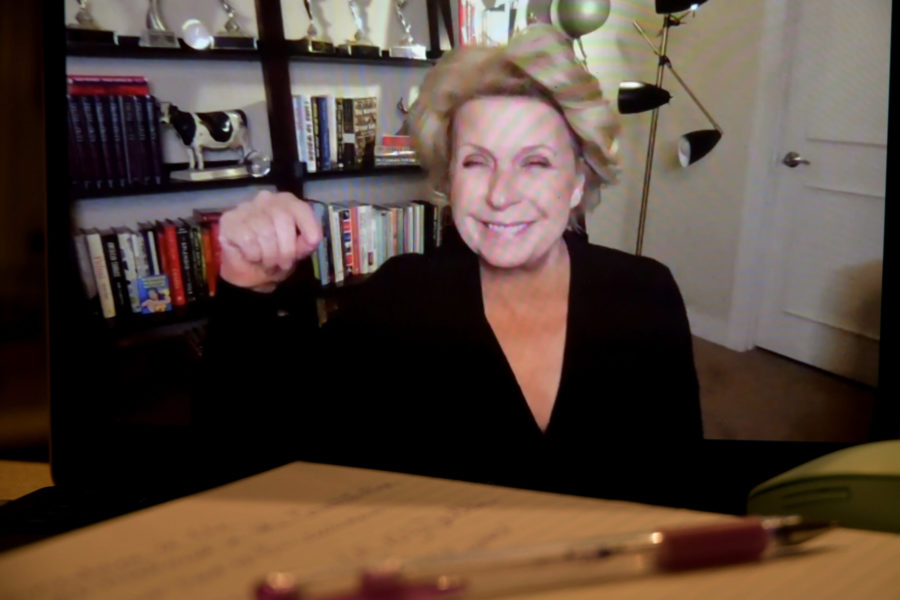

With such a close deadline, the reality of the government defaulting on its responsibilities is realistic. Doris Geide-Stevenson, department chair and professor of economics at WSU, said there is wide concern about the issues of the debt ceiling not being raised.

“There is nobody that says there is anything good about this,” she said. “The consequences in not raising the debt limit would be default. This would mean a downgraded credit rating and higher interest on future lending.”

Such a downgrade in credit rating would then spring a domino effect that would eventually hurt everyone.

“If this does not get resolved in a timely manner, the higher interest rates for the government would mean higher interest rates for the consumers,” Geide-Stevenson said, “as well as slow down the rate of growth in the economy. This means slower recovery than we are seeing now.”

If the federal government is not able to come to an agreement and Geide-Stevenson’s predictions come true, then everyone is in for a tough time. Interest rates on home, car and student loans can go up, and job growth in the economy will slow down.