What’s in the future for college tuition?

According to marketwatch.com, the total amount of student debt is over $1.3 trillion. About 40 million Americans have student loans, and 70 percent of students graduate with debt.

College tuition is one of the big debates in the national conversation thanks to presidential candidate Bernie Sanders promising free college tuition at public universities as part of his platform.

But not everyone is sold on this idea. Questions regarding how such an initiative will be funded, what it will do to innovation within universities and how high enrollment demands may actually limit students from attaining a degree are all being brought up.

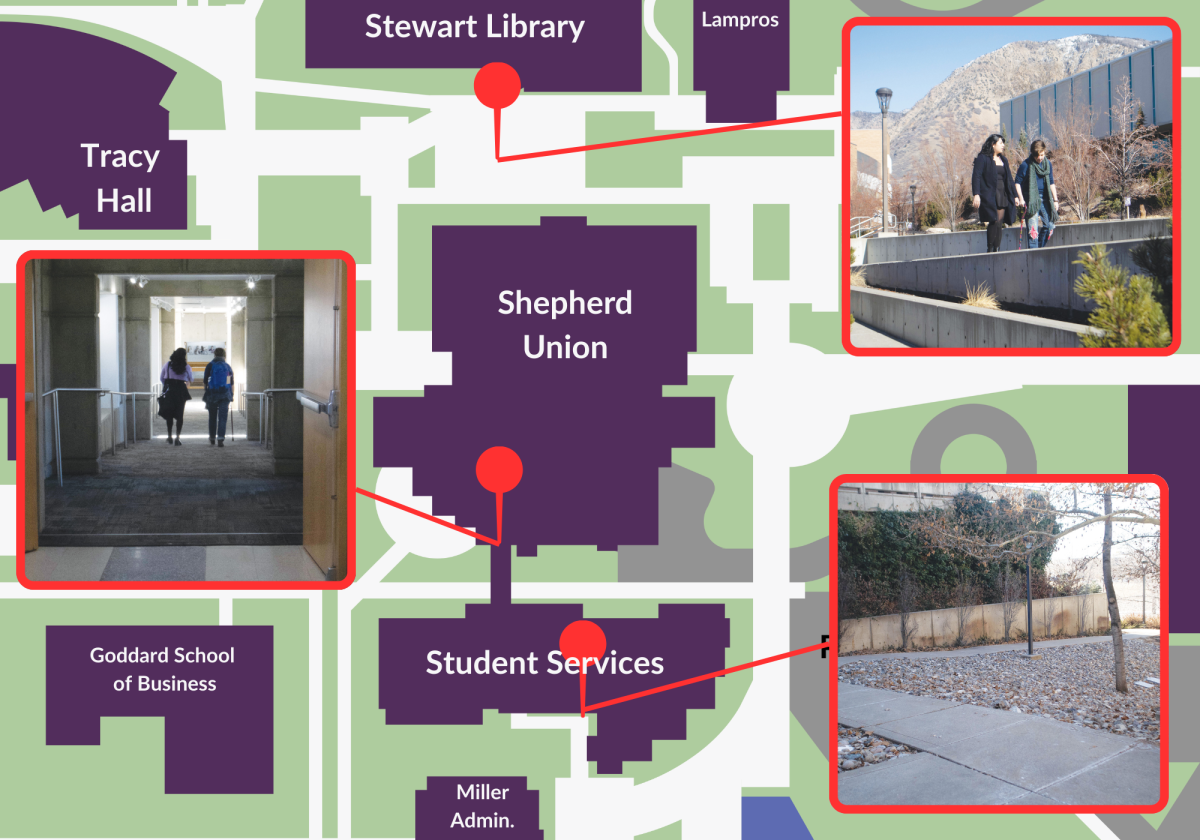

At Weber State University, a discussion panel convened on April 5 in the Shepherd Union Fireplace Lounge to discuss these issues.

Members of the Walker institute invited WSU President Chuck Wight, Utah Senator and former WSU President Ann Millner and former Provost Mike Vaughn to talk about the pros and cons of paying for college tuition.

Standard Examiner’s Executive Editor Greg Halling moderated the event. Halling asked the panel to talk about student debt at Weber.

President Wight said nearly half of Weber’s student population graduates with debt. The national average for student debt is $29,000, and Utah’s average is $19,000. Weber students graduate with an even lower average of $13,000.

“It’s something which, in most cases, is manageable to pay off,” said President Wight.

But Weber students, or even Utah students in general, are still pretty debt averse.

Carol McNamara, director of the Walker institute, said she understands why students are debt averse, saying that student loans can be scary and that many students have families to think about.

“I respect that,” McNamara said. “But I also think they have to be willing to take some risks and to make investments in themselves for the future.”

McNamara reiterated much of what the panel discussed when she said that taking out student loans is like an investment in your future. Students need to be smart about the loans, and they have to keep in mind that the borrowed money now helps them to attain a better-paying job in the future with which they can pay off their loans.

McNamara also said that students often get in trouble with their loans when they take a break or even quit college before getting the good job that can make paying off student loans feasible.

Another question Halling posed was how to address the student debt problem. “Where do we go next? …. I’ve reduced them to speechlessness,” he said.

After an awkward pause, the panel began offering ideas.

Vaughn didn’t come up with a possible solution. However, he did mention one issue that colleges are facing regarding student debt and default. He said that as colleges reach out to minority populations that may not have the financial means to pay for college, student loans and default rates generally increase.

So colleges have to decide between reaching out to those populations and reducing student debt and default rates. “It’s a dilemma that you would need to grapple with,” Vaughn said.

President Wight said we need better financial literacy programs to teach students about the risks of debt in relation to the benefits of getting a college education.

Senator Millner said she would like to encourage parents and others to save for their children’s college education by building state-level initiatives with a sort of last-dollar approach. Students would use whatever financial resources available to them first, and then the state would pay for whatever is left.

Senator Millner said, “I think we have to think about this as shared responsibility.”